People who follow my blog (or read my textbook) are well aware of the fact that corporate reputations can be a major source of value creation for companies. It deserves therefore to be managed just like other assets of a company! A recent study by the Institute for Public Relations supports this thesis, by attempting to but a monetary figure to the contribution of reputation to company value.

The idea behind IPR’s “reputation dividend” is the ability of investors to rely on a company’s reputation as a vehicle to guide and secure confidence in the economic returns they were expecting from their investments. The 2016 report (which covers companies listed in the US) notes that reputations accounted for an average of 20.7% of market capitalization across the S&P 500, up from 18.2% a year earlier – or, to put a $-value to it, $4bn worth of shareholder value per company in the index. Some if this might be influenced by aspects or corporate leadership on reputation and thus company value, as recently argued on this blog.

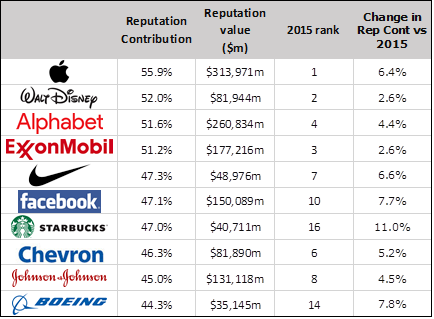

The reputation dividend obviously differs widely by sector and company and a look at the ten companies with the highest contribution of reputation to company value is a real treat to communication strategists:

The study is freely available for download at:

http://www.instituteforpr.org/wp-content/uploads/US-2016_Rep_Div_Report.pdf